ICG Commodity Update – August 2023

The ICG Commodity Update is our monthly published comment on the energy, industrial metals and precious metals market.

Energy

Driven by OPEC+ production cuts and lower crude exports, oil inventories have declined sharply in recent weeks and supported prices. Options markets have seen a flurry of bullish activity in recent weeks, with call volumes on the US oil futures rising to the highest since May. Gloomy narratives about China’s economic prospects are failing to capture the true dynamics of energy demand in the world’s largest crude oil importer, as indicated by numerous executives representing leading oil trading firms during a significant conference in Asia. World oil demand hit a record 103mboe/d in June and August could see yet another peak according to the IEA. World oil demand is scaling record highs, boosted by strong summer air travel, increased oil use in power generation and surging Chinese petrochemical activity. Global oil demand is set to expand by 2.2mboe/d to 102.2mboe/d in 2023, with China accounting for more than 70% of growth the IEA said. Over the coming days, Saudi Arabia is likely to provide guidance on whether it will extend the 1mboe/d extra voluntary production cut, which is in place from July to September. Saudi crude exports (excluding flows from the Neutral Zone) were estimated at 5.47mboe/d in the first 27 days of August, down more than 0.9mboe/d MoM and at the lowest level since April 2021, according to Petro-Logistics. Saudi Arabia is widely expected by traders to follow suit by pushing its voluntary curbs into October. Russia has already agreed with OPEC+ partners to cut oil exports next month, Deputy Prime Minister of Russia Alexander Novak said last week. Oil and gas equities had a strong start into 2H23 making up a lot of ground vs the broader market driven by spot price increases in oil and natural gas. Most analysts think that costs are a tailwind for the group, but they will be for everyone. Nevertheless, the market has been increasingly rewarding those with stronger financial and operating leverage in the improving commodity price environment. M&A was once again a topic in the sector after Permian Resources decided to acquire Earthstone Energy in an all-stock deal valued at $4.5bn to boost its position in the Delaware Basin.

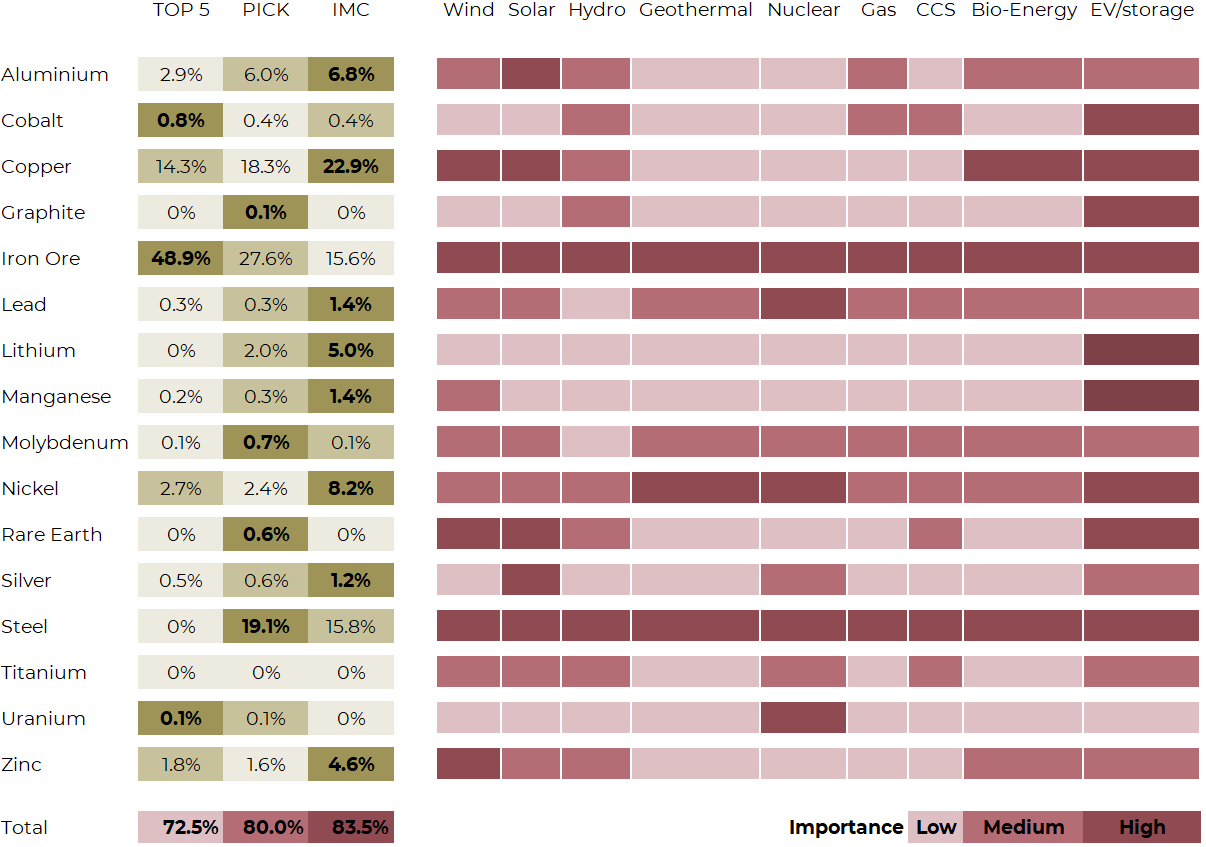

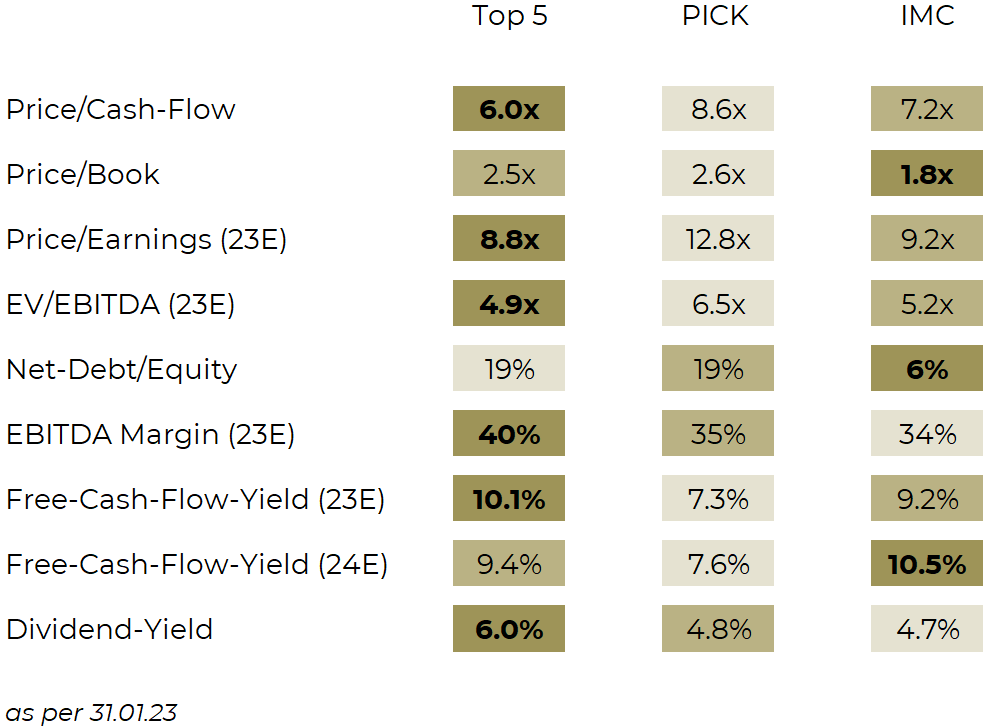

Industrial Metals

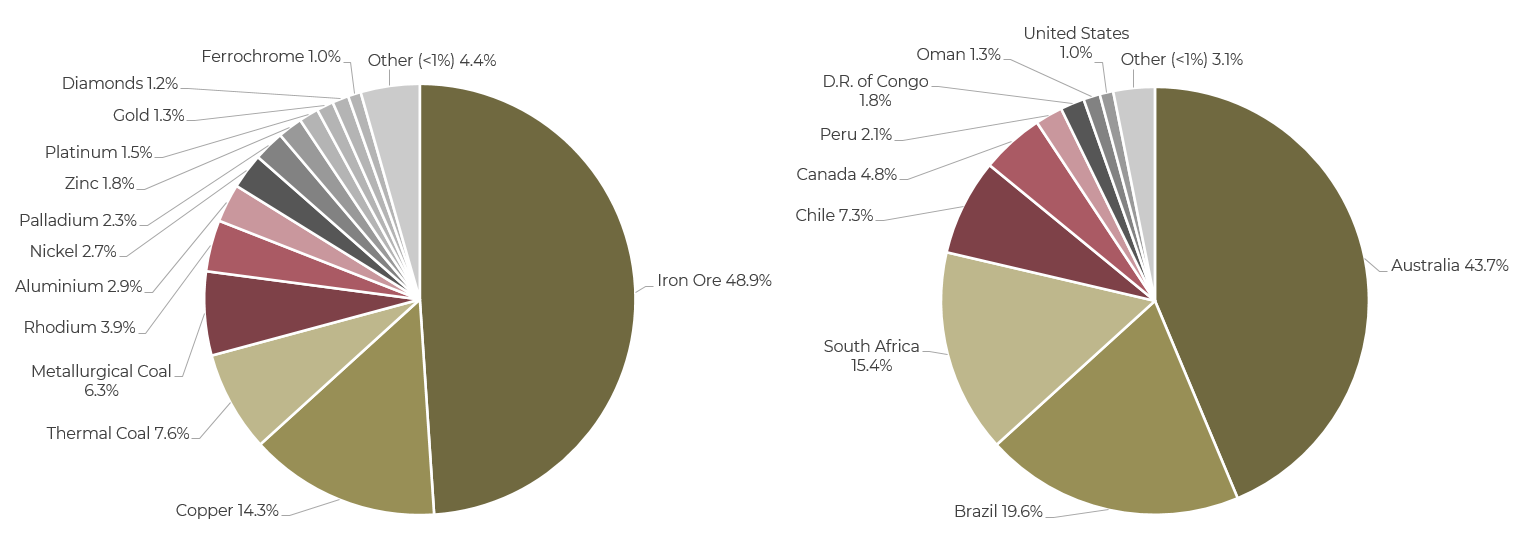

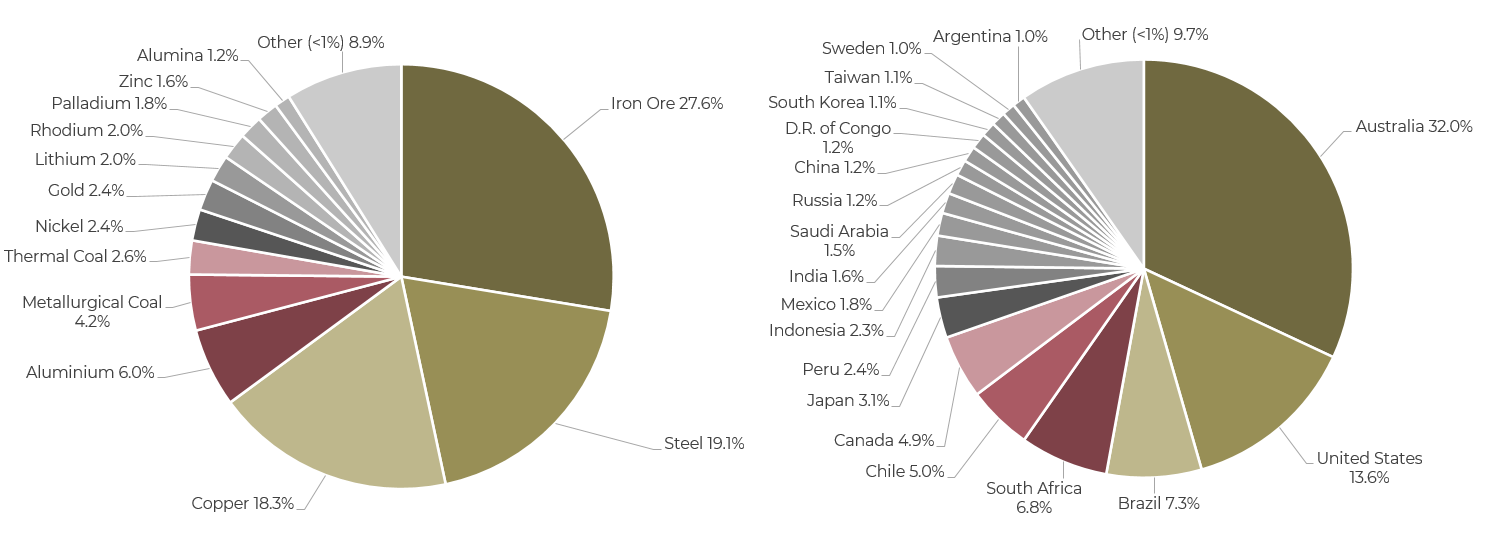

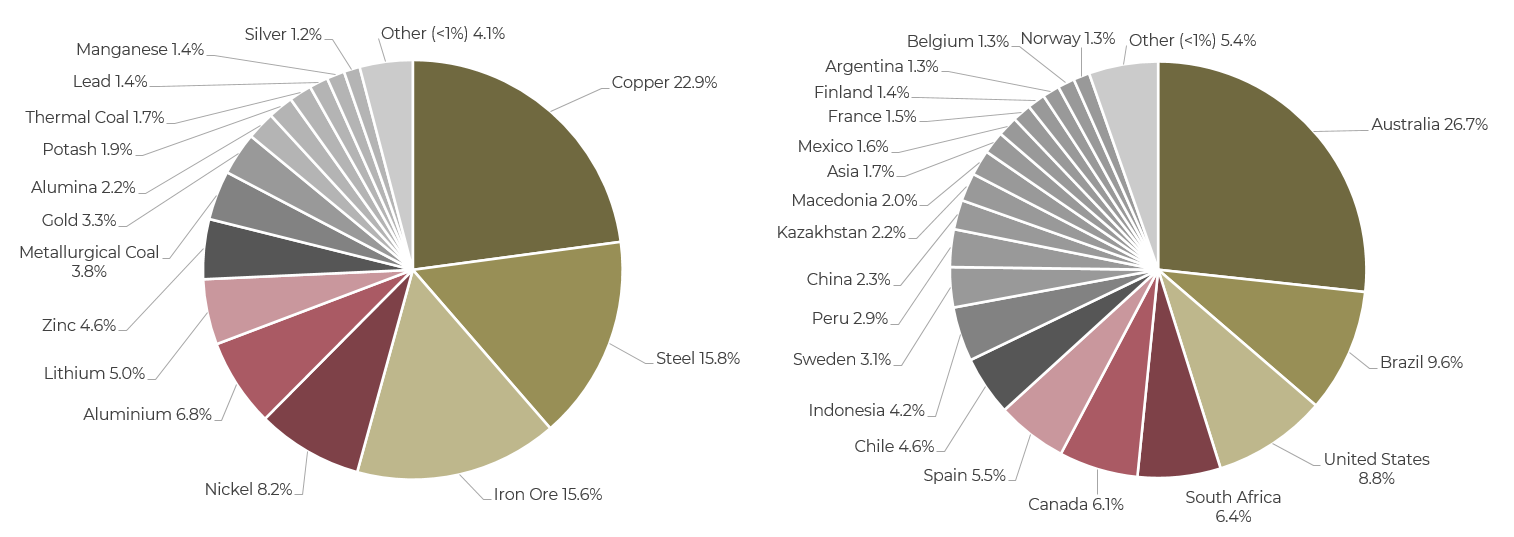

In August, China’s economic outlook has showed little signs of improvement. On the contrary, the domestic property crisis seems to have deepened with two of the country’s major real estate developers, Evergrande and Country Garden, facing severe financial difficulties. Evergrande has filed for chapter 15 bankruptcy protection and Country Garden last week reported a $6.7bn loss for H1 2023, adding to worries of a disastrous default in the coming weeks. This has sent waves through China and the global economy. The rating agency Fitch expects Chinese GDP momentum to slow and has downgraded its China 2023 GDP Forecast from 5.6% to 4.8%. The ongoing worries about demand from the world’s most significant commodity buyer have weighed on base metal prices. BHP announced that its full-year profits fell as much as 37% as China’s metal demand wanes. Nevertheless, analysts have signalled that the slump might be bottoming out. One such sign was China’s manufacturing contraction which slightly eased in August. The manufacturing PMI rose to 49.7, topping estimates and nearing the 50 level that would signal activity has stopped contracting. The Caixin PMI rose to 51.0 in August vs. 49.2 in June. Firms reported increases in output and new order intakes, despite a continued downturn in new export orders, indicating domestic demand was the main source of growth. This has raised hopes that the governments efforts to boost the economy are starting to bear fruits. Last week, the Chinese government announced it is further ramping up its campaign to boost the economy. What impact do the recent developments in China have on industrial metals? Looking at copper for example, it seems as if the metal is stuck between a new energy transition super-cycle and the gravitational pull of the old Chinese super-cycle. We explore the current and future dynamics of the copper market in quite some detail in our recently published research report “Copper – What Else?”. Speaking about copper but on the company side, Aurubis warned it may face losses in the hundreds of millions of euros after being hit by a massive scam involving shipments of scrap metal that it uses in its recycling business. Australian lithium miner Liontown Resources said it’s willing to back a new AUD 6.6bn takeover offer from Albemarle. Glencore has a new rival in its bid to acquire Teck Resources coal division. India’s biggest steel producer JSW Steel is looking to snap up a major stake in Teck’s coal unit according to its chairman.

Precious Metals

The rising chance of a “soft landing” for the US economy and subsequently higher nominal and real US yields have resulted in a stronger US dollar and weaker gold price lately. In addition to the macro headwinds, recent World Gold Council demand data showed a normalization. Total demand fell 19% QoQ and 2.5% YoY in 2Q23, and it dropped 5.6% YoY in 1H23 versus 1H22. Central bank buying slowed in Q2 but remained resolutely positive. Net purchases slowed to around 102 metric tons (mt) in 2Q23 driven by sales from the Turkish central bank of around 132mt. Nevertheless, the 1H23 central bank buying was around 387mt, which was a record “half year” amount. UBS expects central banks to buy 700 metric tons in 2023. If achieved, it would be the second highest number of purchases for a year since the mid-1960s – following the 1’110 metric tons purchased in 2022. A step-up in official sector buying was crucial to the strength of gold prices amid rising real interest rates in 2022. This, combined with healthy investment and resilient jewelry demand, may create a supportive environment for gold prices. On the company side at 2Q23 conference calls, management teams generally noted stabilizing input costs and/or initial signs of easing inflationary pressures, but no meaningful improvements to the overall cost structure yet. Consumables prices have started to soften a little (e.g., diesel) while elevated labor costs remain a challenge, particularly for Canadian operations. Interestingly, the two big gold producers Newmont and Barrick guided to a second half weighted production. Production will have to pick up meaningfully to meet annual production guidance. Interestingly, that according to the WSJ, Saudi Arabia is interesting in acquiring Barrick’s 25% stake in Reko Diq copper-gold mine project in Pakistan. On the gepolitical side, Mali’s interim President Assimi Goita signed into law a new mining code that allows the government and local investors to take up to a 35% stake in mining projects vs. 20% currently. However, it is unclear if the new mining code affects existing projects.

Read More