ICG Commodity Update – January 2023

The ICG Commodity Update is our monthly published comment on the energy, industrial metals and precious metals market.

Energy

Oil has been bumpy in recent months – supported by demand expectations from China but with pressure from contraction fears in western economies. Nevertheless, China’s rapid shift to reopen its economy following lengthy lockdowns should help oil demand rise to a record level this year, the IEA said, lifting its forecast for oil demand growth this year by 200kboe/d to 1.9mboe/d. Traders expect China to resume buying high quantities of oil through the spring. Indeed, preliminary announcements by various agencies suggest that the Chinese New Year celebrations boosted mobility – domestic travel jumped to 90% of 2019 levels. Analysts expect that China alone could add 1.5mboe/d in 2023. A similarly sudden turnaround for the fortunes of economies in Europe and the US is also boosting oil-demand expectations, according to the IEA. Europe’s economy this year is expected to fare better than previously forecast, as warmer temperatures have eased its energy supply crisis. The US had also a mild January that caused natural gas prices to fall to $3/mcf. The extra oil demand means that the IEA now expects total oil demand this year to average 101.7mboe/d, well above pre-Covid levels and a record amount. The EIA (US) expects 1.0mboe/d and OPEC 2.2mboe/d growth this year. Global oil supply is also expected to grow, led by the US and Iran. Markets could be in deficit until 3Q23 resulting in a decline in already low inventories, thereby tightening the oil market – while SPR releases were an effective tool to help control oil prices in the 2H22, President Biden’s ability to use them as effectively in 2023 is probably more limited. Over the next weeks oil and gas companies will report their 4Q22 results, highlighting the record-high profit generated last year. Oil and gas companies’ contribution to the S&P 500 Index’s earnings has nearly doubled compared to 2022. Energy now represents more than 10% of the S&P 500’s estimated net income, up from 6.5% a year ago. Still, energy makes up only 5.3% of the index’s market capitalization even after a big outperformance in stock prices last year. Disciplined reinvestment and capital return remain key drivers for the industry. Shell reported $40bn net profit last year, 70% higher than eight years ago in 2014, when prices were at similar levels and the ECF was launched. That says something about how the industry has changed over that years.

Industrial Metals

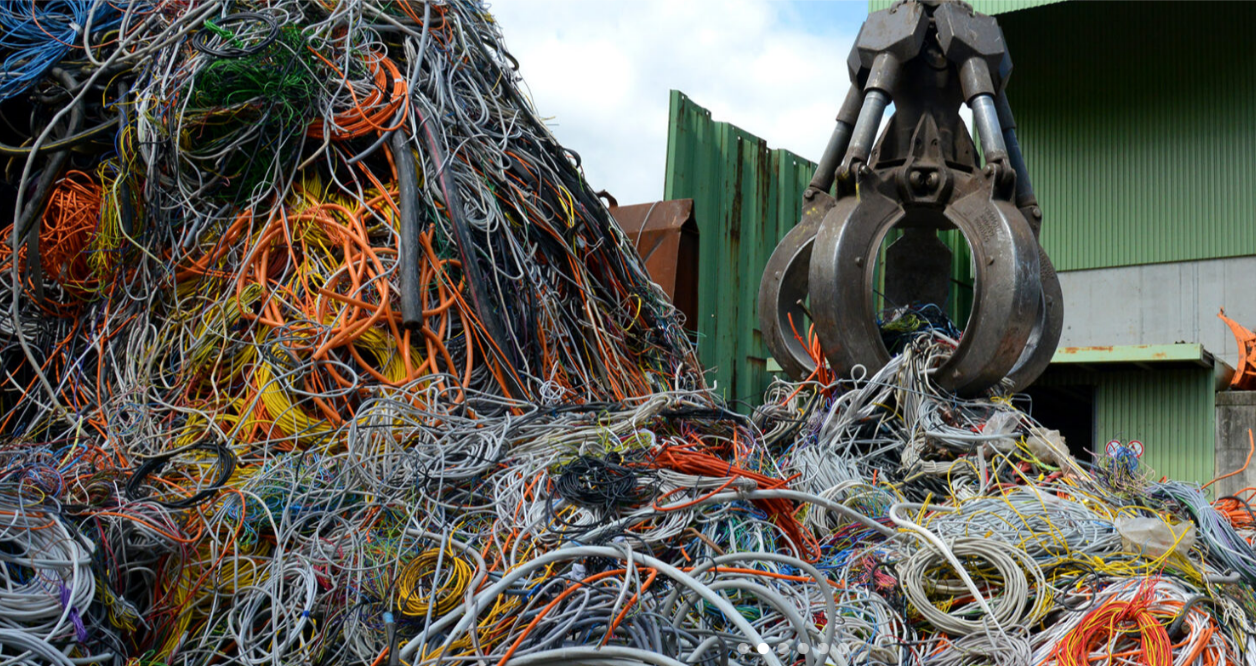

After strong commodity prices seen through the first half of 2022, the second half of the year was significantly less exciting, with generally lower commodity prices into Q4 and cost inflation concerns taking some of the free cash flow margins out of the sector. According to analysts and seen in some of the most recent Q4 reporting, mining companies continue to generate strong cash flows and given strong balance sheets, the potential to provide attractive returns to shareholders. Miners have rallied into the new year, buoyed by higher commodity prices, lower inventory levels and improving sentiment on China, with economic expectations now appearing higher than previously thought. According to BMO, relative to industrial metal peers, copper demand in China performed well in 2022, with 2.9% year over year growth to ~14.4Mt (refined copper basis). While below the average for the past ten years, this did mark acceleration from 2021’s negligible growth. Meanwhile, copper inventory also dropped for the second year in a row. A group of base metals led by tin, zinc and copper have surged more than 20% in three months, further supported by the US Federal Reserve signalling a slowdown in the pace of interest rate rises and a softening in the US dollar, which importers use to buy commodities. Another upside risk for already tight copper markets is the social unrest in number two miner Peru (10% of total world mined supply). Protests have rocked the country for almost two months following the impeachment and replacement of former President Pedro Castillo. About 30% of Peru’s copper production is at risk. One of the largest mines, the Las Bambas facility, is currently shut amid a shortage of critical supplies caused by road blockages in the area. There are also supply risks in neighboring Chile, the world’s largest copper producing country. Project delays prompted a Chilean government agency to tone down its projections for copper output in the top-producing nation, the latest sign of the challenges facing the industry as demand for the wiring metal increases. Developing new projects is getting trickier and pricier given increased scrutiny on environmental and social issues and the need to dig deeper. In the case of Chile, permitting difficulties combined with efforts to increase taxes and re-write the constitution have led companies such as BHP, Antofagasta and Freeport-McMoRan to put off decisions on major investments.

Precious Metals

According to the World Gold Council, 2022 was one of the strongest years for gold demand in over a decade. Annual gold demand (excluding OTC) jumped 18% to 4,741 tons, almost on a par with 2011 – a time of exceptional investment demand. Two years on from dropping to its lowest level in a decade, central bank demand has rebounded strongly. 2022 saw the second consecutive year-over-year increase in demand from this sector, with net purchases totaling 1,136 tons. This marked a banner year for central bank buying: 2022 was not only the 13th consecutive year of net purchases, but also the second highest level of annual demand on record back to 1950. Mine supply on the other hand increased by only 1% year-over-year to 3,612 tons. Chinese production rebounded, but this was mostly attributed to base effects after wide-ranging shutdowns in 2021. Recycling volumes were also subdued, which meant total gold supply rose only 2% year-over-year to 4,755 tons over 2022. Looking at Silver, Endeavour Silver said there was a supply shortfall of nearly 200 million ounces in 2022. In general, Primary silver reserves are declining as mining depletion exceeded additions. However, silver is a green metal which supports rising industrial demand, placing upwards pressure on the price of silver. While 80% of supply is sourced from mining, 20% comes from scrap – according to the company, silver scrap recycling is at a 25-year low and over the past 10 years, the silver industry has been in a 500m ounce physical deficit. Investors should be aware that an average solar panel uses about 20 grams of silver, meaning, every Gigawatt of solar power needs 2.8 million ounces of silver. Also, battery powered electric vehicles have twice as much silver as internal combustion. With silver being produced primarily as a by-product of base metals mines, grades falling for years, and new deposits are scarce, silver prices could rise in the future. On the company side, the worlds largest gold producer, Barrick Gold, announced that the company’s output in 2022 slid to its lowest level since 2000, missing analysts’ expectations and its own target as operational woes curbed production. Acquisitions could help lift Barrick’s metals output while awaiting longer-term projects to come to fruition. The CEO said in an interview that he’s focusing on deals in “the junior part of the market” this year.

Read More