Commodities to become mainstream – again.

KEY TAKE-AWAY

- The war in the Ukraine has destabilized global commodity markets heavily

- Many commodity markets had already tightened significantly prior to the invasion

- The bull case for commodities rests not on the current geopolitical unrest, it only reinforces it

- A lower correlation between commodities and other asset classes speaks for commodities in a portfolio context

- Metals are in the heart of the super-cycle

- Natural resource equities are the cheapest they’ve been in the last 100 years on some metrics and on top in their best shape in history

- Investors should not view commodities as risk assets, they are an all-weather asset

- Our ICG Investment Solutions have done exceptionally well absolute as well as relative

A crisis is unfolding – A crisis of commodities

The brutal Russian invasion of the Ukraine is terrible and causes awful human suffering with unpredictable consequences. Indeed, the war in the Ukraine has destabilized global commodity markets heavily. The storm of supply disruptions, logistic issues, sanctions, and purchasing manager panic has seen some of the most dramatic rises seen in history. Anyone in the commodities world is experiencing a perfect storm as correlations suddenly shot to 1, which is never a good thing. But that’s precisely what happens when the Western sanctions the single-largest commodity producer of the world, which sells virtually everything. What we are seeing at the 50-year anniversary of the 1973 OPEC supply shock is something similar but substantially worse – the 2022 Russia supply shock, which isn’t driven by the supplier but the consumer.

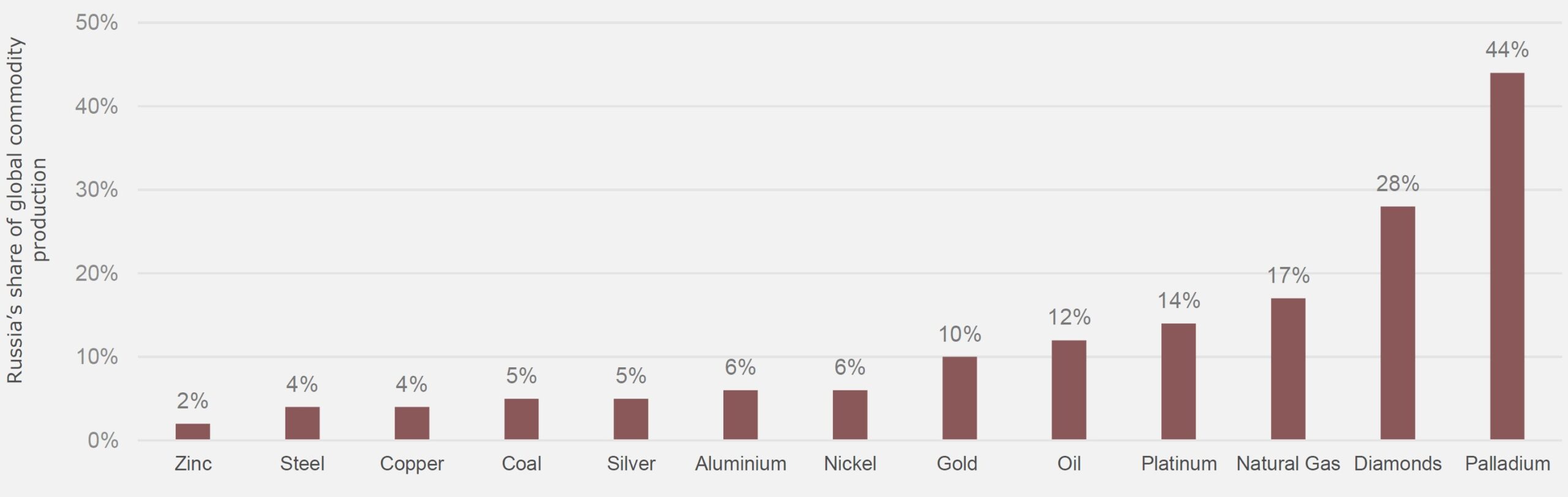

Russia is an important producer and player in the world of commodities

Russia is the world’s third largest producer of oil (11.5% of global output) and second largest exporter of oil. At risk in total on the energy side is 4.3mboe/d of oil, 2.8mboe/d of oil products and 120bcm of gas. While commodities are fully carved out from the sanctions package, it is clear that Russian oil is being ostracized. About 2/ 3 of Russian oil was struggling to find buyers even at hugely discounted prices. In metals the risk amounts to 3mt aluminum, 700kt copper, 135kt nickel, 3moz palladium and 700koz platinum. So far no metals producers have explicitly been sanctioned. There has not been any significant disruptions to the flow of base and precious metals exports from Russia, particularly for long term contracts, though prices are reflecting an immense risk. (as of 15th March 2022)

The importance of commodity security

Nearly every single commodity is trading well above its respective cost curve, and higher than seen three months ago – a very rare event. Undeniably, the Russian invasion of Ukraine has played a key role in this. As such, some commodities are rallying for the wrong reasons – significantly higher global risk and disruptions to not only trade flows but also fears around security and stability disruptions not seen in a generation. However, some commodity markets had already tightened significantly prior to the invasion. Much of the past two years have seen a positive fundamental trend helping prices higher on the back of supply underinvestment and recovering demand. While this break from the trend has been a positive one for prices, not even producers truly believe this is a good thing. Steady, managed price rises are good for the industry value chain. Under a scenario of broad self-sanctioning, demand destruction becomes an immediate necessity. So far we have seen limited signs of demand easing. Strong economic growth is boosting consumption of energy and metals. Nevertheless, the market for commodities is not going to be what it was.

Investors need to increase commodity exposure

Commodities were one of the best-performing asset classes of 2021.

- The Bloomberg Commodity Index was up 25% in 2021 and as of 15th of March, up another 22% in 2022

Indeed, commodity markets have moved in the opposite direction of global equities so far this year. The bull case for commodities rests not on the current geopolitical unrest, it only reinforces it. With commodities also providing an effective hedge against this risk, the case for owning commodities has never been stronger. However, investor exposure to commodities is still record low (below 2% ex-gold).

Historically commodities and gold can be a good inflation hedge

A lower correlation between commodities and other asset classes speaks for commodities in a portfolio context. The commodities chaos caused by Russia’s war in Ukraine will reverberate through the global economy, sparking industry shortages and quickening inflation already at the highest in decades. While the exact path for inflation remains highly uncertain, commodities are one of the best assets to position against rising inflation given their high correlation to market-based measures of inflation expectations.

Metals are in the heart of the super-cycle

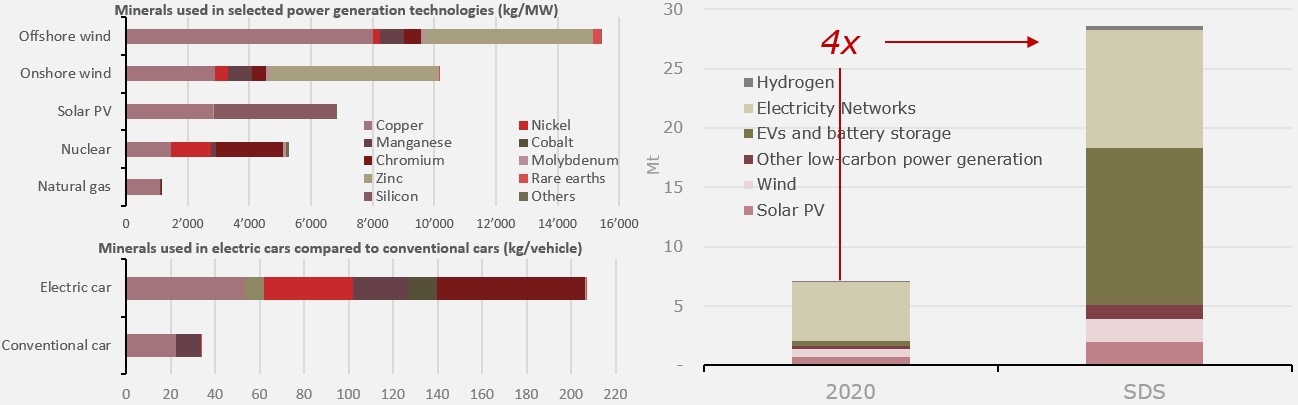

Government ambitions globally have grown markedly in the past few years pointing to new, increased momentum in tackling climate change. Indeed, plans to make the world fossil fuel independent increased significantly with the Russia invasion of Ukraine. Further to that, the structure of energy demand changes, with the importance of fossil fuels gradually declining, replaced by a growing share of renewable energy and increasing electrification.

- An energy system powered by clean energy technologies differs profoundly from one fueled by traditional hydrocarbon resources as they generally require more minerals than their fossil fuel based counterparts. These raw materials are a significant element in the cost structure of many technologies required in the energy transition

- Metal demand for clean energy technologies would rise at least 4x by 2040 to meet climate goals, particularly EV related metals

Metal demand for renewable energy technologies to quadruplicate

Metal demand* according to the IEA “the role of critical minerals” excludes steel and aluminium that are also very important in the green energy transition. IEA Sustainable Development Scenario (SDS) estimates that a surge in clean energy policies and investment puts the energy system on track to achieve sustainable energy objectives, including the Paris Agreement, energy access and air quality goals.

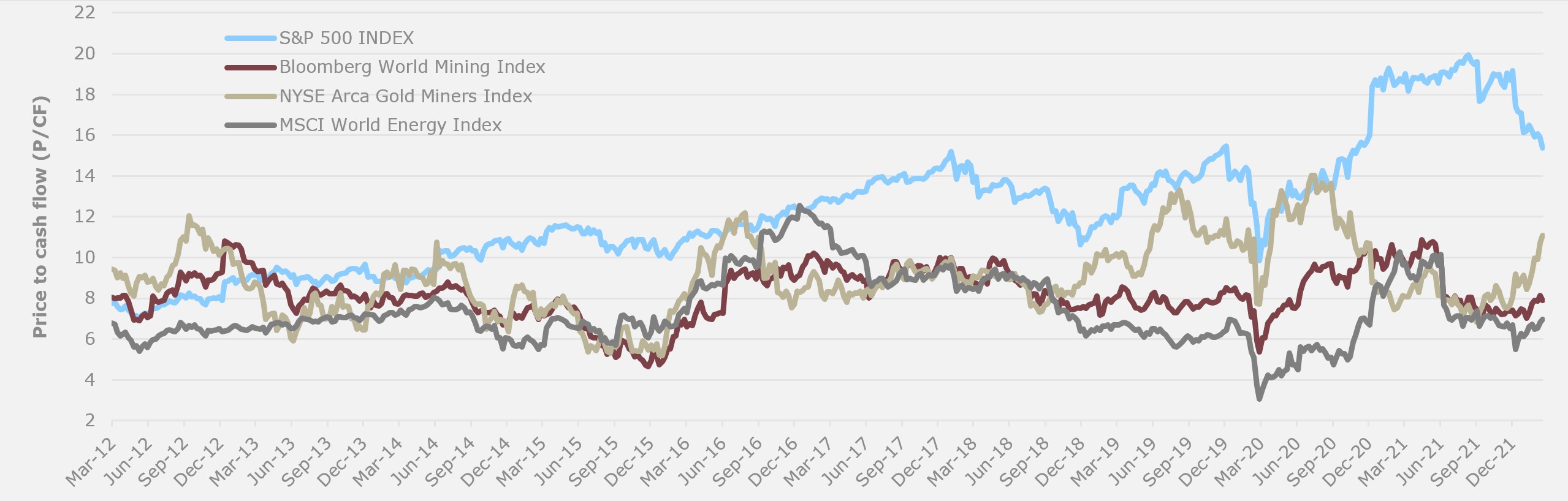

Producers are in their best shape in history

The exposure to natural resource equities remains very low by historical standards and in relation to the earnings contribution to the market. Balance sheets are healthier that at any point in history and natural resource equities are the cheapest they’ve been in the last 100 years on some metrics

- Energy makes only 4% of the S&P 500 Index weight, but the Oil & Gas producers account for 9% of the market’s earnings and 12% of free cash flow

- The precious metal producers have accumulated a net debt/equity ratio that is negative resp. more cash than debt, therefore debt-free

- While the S&P 500 price to cash flow increased over the last year, the one of the natural resource space declined. This means, that the prices of the stocks of the S&P500 increased more than their cash flow. However, the cash flow of the natural resource space increased much more than their share price. And this after a strong performance already

Big gap between the S&P 500 Index P/CF to that of the natural resource producers

In addition to attractive returns, natural resource equities offer investors diversification, inflation protection, a margin of safety, inefficiencies, and optionality. We remain convinced, as with commodities, natural resource equities should be part of a portfolio as the companies are in their best shape in history and valuation metrics continue to stay at attractive levels.

Investors should not view commodities as risk assets

commodities are an all-weather asset

Investment Solutions

Industrial Metals Champions Fund +207.7% over 2 years

Energy Champions Fund +207.5% over 2 years

Precious Metals Champions Fund +8.4% over 1 year

We invest in the top 25 producers on each sub-sector thanks to a qualitative and quantitative scorecard investment process and those companies resp. natural resource producers are currently very attractive. Therefore all investment funds managed by Independent Capital Group AG are based on proven quantitative multi-factor models that are solely based on unemotional systematic and methodological processes.

- For example, country risk management has always been an integral part of our ICG Alpha Scorecard. We began reducing the direct Russian exposure towards the end of 4th Q 2021 when the country risk factor signaled an increasing geopolitical risk dynamic. As a consequence we have now no Russian exposure left.

Feel free to contact us if you want to have more information on our funds, our investment process, a commodity update or a second opinion on any natural resource company.