Administrating and managing substantial wealth persistently over time requires a lot of time and effort. Responsible investing criteria play an important role in the investment preferences of wealthy families.

As a multi-family office with many years of experience, we provide professional and discreet support in the allocation and management of your family’s assets.

We develop customised solutions to ensure continuity in the preservation of your family assets.

“Finding good partners is the key to success in anything: in business, in marriage and, especially, in investing.”

― Robert Kiyosaki

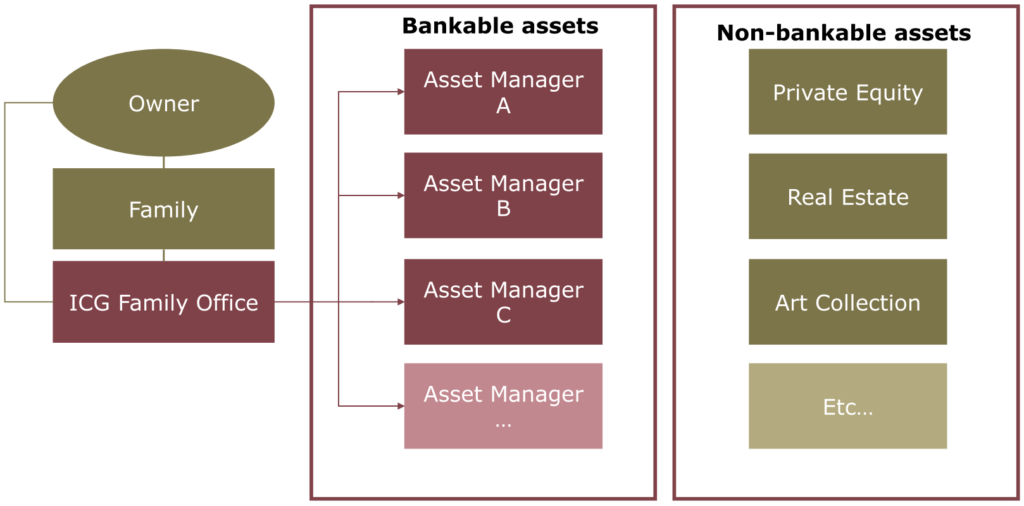

In addition to our investment advice, we support clients with a variety of customisable services. These include consolidated asset and liability overviews, wealth and cash flow planning or the continued monitoring of investment guidelines and transactions. We help clients in administrative matters, financial reporting/audit and provide comprehensive control of their wealth while assuming a coordinating function.

Many multi family offices additionally provide asset management services for their clients, which in our view could cause conflicts of interest. Independent Capital Group AG only acts as investment advisor or manager upon special request of the client.

Support in the coordination of the investment management, maintenance of investment structures and control functions as well as financial planning lie at the core of our service offering and are provided by our in-house professionals. For all other aspects such as insurance, legal and tax issues, we rely on business partners or work with the existing advisors of our clients. All services are offered on a modular basis to match the individual needs of our clients.

Our approach is to provide the same service level as in a Single Family Office, but for multiple clients.

“Daring ideas are like chessmen moved forward. They may be beaten, but they may start a winning game.”

― Johann Wolfgang von Goethe

Based on our long-standing experience as a family office for multiple clients, we are able to offer a tailored solution for the management and administration of your family wealth.

Your advantages:

- Central co-ordination and control of your wealth management

- Relief of general administration tasks

- Access to a team of investment professionals with expertise across all asset classes, including alternative investments and real estate

- Alignment of interest due to our independence from banks

- Succession and estate planning

- Full confidentiality and privacy

Investment Reporting & Controlling

- State of the art portfolio management system and information tools

- Consolidation of accounts and non-bankable assets

- Monitoring & investment controlling

- Tailor-made investment reporting

Financial Planning & Cash Management

- General support in your financial activities such as financing and budgeting

- Financial and cash flow planning

- Coordination with asset managers and banks

- Payment services

Legal, Tax & Succession Planning

- Preparation and filing of tax returns

- Tax advisory in collaboration with external partners

- General compliance & regulatory advice

- Support in estate and succession planning