Posted on

20. October 2020

Lesedauer: ca. 8 Minuten

Key-Points

Beginn des Umdenkens

An der UN-Klimakonferenz in Paris im Dezember 2015 einigten sich 197 Staaten auf ein gemeinsames, globales Klimaschutzabkommen. Das Ziel dieses Abkommens ist die Begrenzung des Anstiegs der globalen Durchschnittstemperatur auf deutlich unter 2 Grad über dem vorindustriellen Niveau. Dadurch sollen die Risiken und Auswirkungen des Klimawandels deutlich reduziert werden. Der Schlüssel für den Erfolg liegt in der oft thematisierten Energiewende und die Verschiebung von fossilen Energiequellen zu erneuerbaren Technologien wie Solar- oder Windenergie. In den letzten Jahren hat ein allgemeines Umdenken stattgefunden. Grosse Unternehmungen haben sich dazu entschieden, enorme Investitionen in den erneuerbaren Energiesektor zu tätigen und tragen dazu bei, den Klimawandel einzudämmen. Nicht nur Technologiefirmen wie Google und Amazon, Elektroautohersteller Tesla oder traditionelle Fahrzeughersteller wie VW und BMW haben sich dem Klimawandel angenommen – auch Energiefirmen wie z.B. Royal Dutch Shell, deren Geschäfte Jahrzehnte lang auf fossilen Energieträgern beruhte, beginnen damit, in neue, saubere Technologien zu investieren. Natürlich kommen diese grundlegenden Veränderungen nicht von heute auf morgen – die Welt befindet sich in dieser Übergangsphase, die nicht nur viel Zeit und Investitionen verlangt, sondern auch bedeutende Mengen an Rohstoffen, insbesondere Metallen, erfordert.

Neue Energiequellen

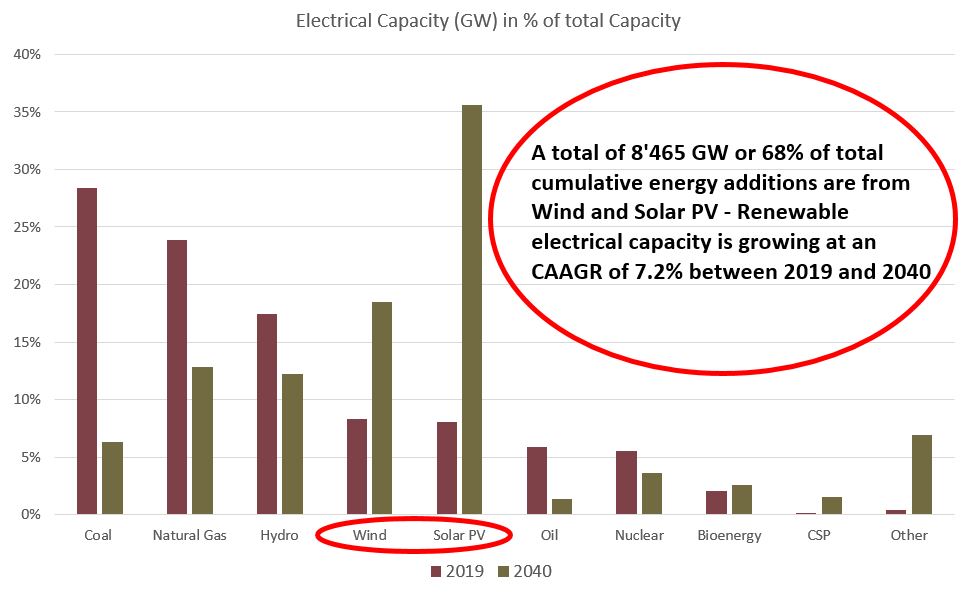

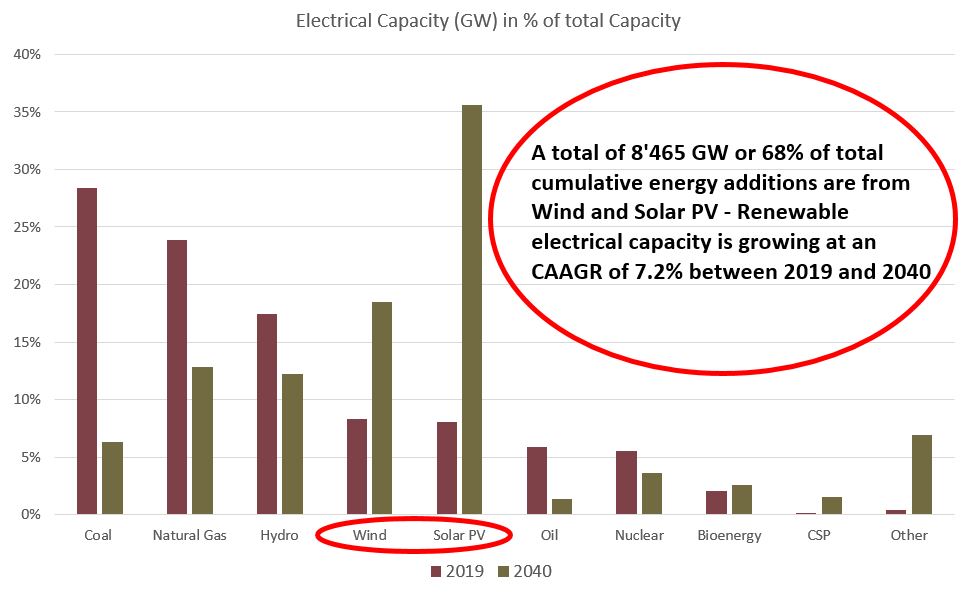

Die folgenden Grafiken verdeutlichen die Auswirkungen der Bestrebungen auf den zukünftigen Energiemix. Die Daten beruhen auf Untersuchungen der International Energy Agency (IEA), welche jährlich ihren World Energy Outlook publiziert.

- Gemäss IEA wird der Anteil von erneuerbarer Energie im Energiemix der Welt von heute 36% auf über 70% im Jahre 2040 steigen – Wind- und Solarenergie tragen den grössten Teil dazu bei.

- Die kumulierte Zunahme in Gigawatt zwischen 2020 und 2040 für Wind und Solar summiert sich auf rund 8‘465 GW (ca. 68% der gesamten Zunahme aller Energiequellen)

- Die elektrische Kapazität der erneuerbaren Energiequellen wächst im selben Zeitraum jährlich um 7.2% durchschnittlich

Während Investitionen beispielsweise in Kohle gegen Null gehen, wächst der Anteil von erneuerbarer Energie und Batterien stetig. Ausserdem erfolgen immense Investitionen ins Stromnetz, das besonders kupferintensiv ist. Das Umdenken gewinnt in Politik und Wirtschaft und in der ganzen Gesellschaft an Momentum. Allgemein wird aber unterschätzt, welch immensen Ressourcen benötigten werden, um diese hochgesteckten Ziele zur Bekämpfung des Klimawandels zu erreichen.

Dies bedeutet, dass die Zeit des Übergangs zu erneuerbaren Technologien im Zeichen der „kritischen Metalle“ – also Metalle die kritisch für die Technologien der erneuerbaren Energien sind – steht. Sofern die Gesellschaft diese Ziele erreichen möchte, braucht es entsprechend genügend Rohstoffe, insbesondere Metalle.

Kritisch für saubere Energien – Industriemetalle

Die Nachfrage nach Materialien und Metallen die für erneuerbare Energielieferanten und -träger verwendet werden, wird in den nächsten Jahrzenten dramatisch steigen. Die World Bank berechnet, dass die Nachfrage für Materialien, welche vor allem für Solarpanels benötigt werden – also z.B. Kupfer, Eisenerz, Blei, Molybdän, Nickel und Zink – bis ins Jahr 2050 um über 300% steigen wird. Diese Verdreifachung der Nachfrage lässt sämtliche anderen Sektoren, in denen diese Rohstoffe benützt werden, ausser Acht. Allgemein schätzt die World Bank, dass in den nächsten 30 Jahren mehr als 3 Milliarden Tonnen Rohmaterialien geschürft werden müssen, um genügen Rohstoffe für die Produktion von erneuerbarer Energiequellen und Speicherung bereitstellen zu könne – dies nur um den Base Case des Pariser Abkommen zu erreichen.

Neben den klassischen Metallen (Kupfer, Zink, etc.) brauchen die neuen Technologien vermehrt auch Rohstoffe wie Lithium, Kobalt oder seltene Erden, welche oft mit geopolitischen und ökologischen Problemen behaftet sind. Auf Grund ihrer besonderen Bedeutung für die Elektromobilität stuft die World Bank diese Rohstoffe als „high-impact“-Materialien ein. Andere Metalle, wie Kupfer, Nickel und Molybdän hingegen gehören zu den „cross-cutting“-Materialien, also Metalle die unabhängig von Technologie dringend für die Energiewende benötigt werden.

Gemäss Analysten müsste der Kupfersektor bis 2030 jährlich um 5.7% wachsen um die zusätzliche Nachfrage der erneuerbaren Technologien bedienen zu können – historisch gesehen konnte der Kupfersektor zwischen 2000 und 2018 jedoch nur um 2.6% wachsen. Die Kupferproduktion müsste also mehr als doppelt so schnell wachsen wie zu Beginn dieses Millenniums. Zum Vergleich, der grösste Kupferproduzent der Welt, Codelco, produzierte im Jahre 2019 1.7 Millionen Tonnen Kupfer pro Jahr. Kupfer hat also den grössten Bezug zur grünen Energiewelle, wenn man die absoluten Mengen betrachtet.

Der Molybdänmarkt ist eine Nische und im Vergleich zu Kupfer sehr klein. Pro Jahr werden ca. 300‘000 Tonnen des Materials produziert. Obwohl nur gerade 0.15% einer Windturbine aus Molybdän besteht, bedarf die Nachfrage nach Wind und Geothermie bis ins Jahr 2050 ein zusätzliches Angebot von knapp 800‘000 Tonnen – also mehr als doppelt so viel wie heute. Um zu veranschaulichen, wie wichtig Industriemetalle für erneuerbare Energietechnologien sind, bedienen wir uns zweier Grafiken der World Bank, die den Anteil der Rohstoffnachfrage, respektive der Zusammensetzung nach Material für Solar- und Windenergie grafisch darstellt.

Bedeutung der Elektromobilität

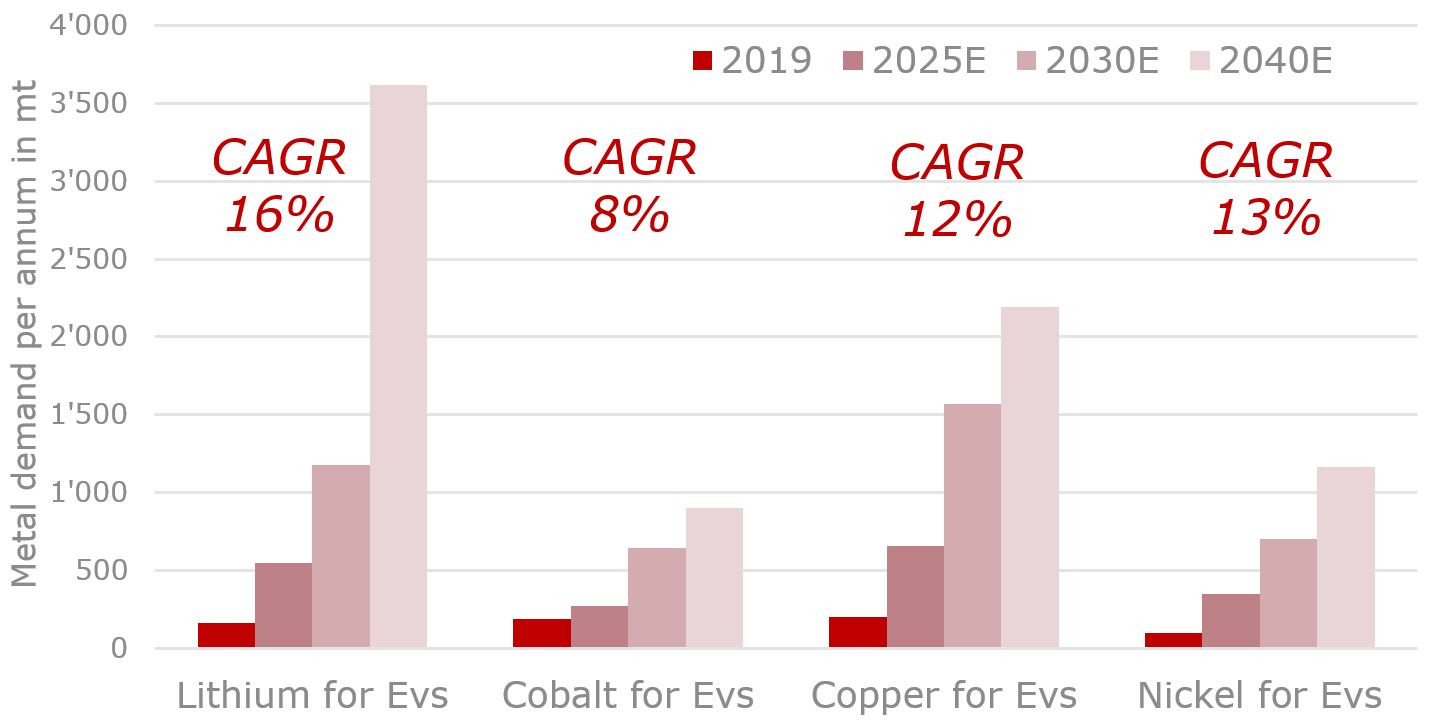

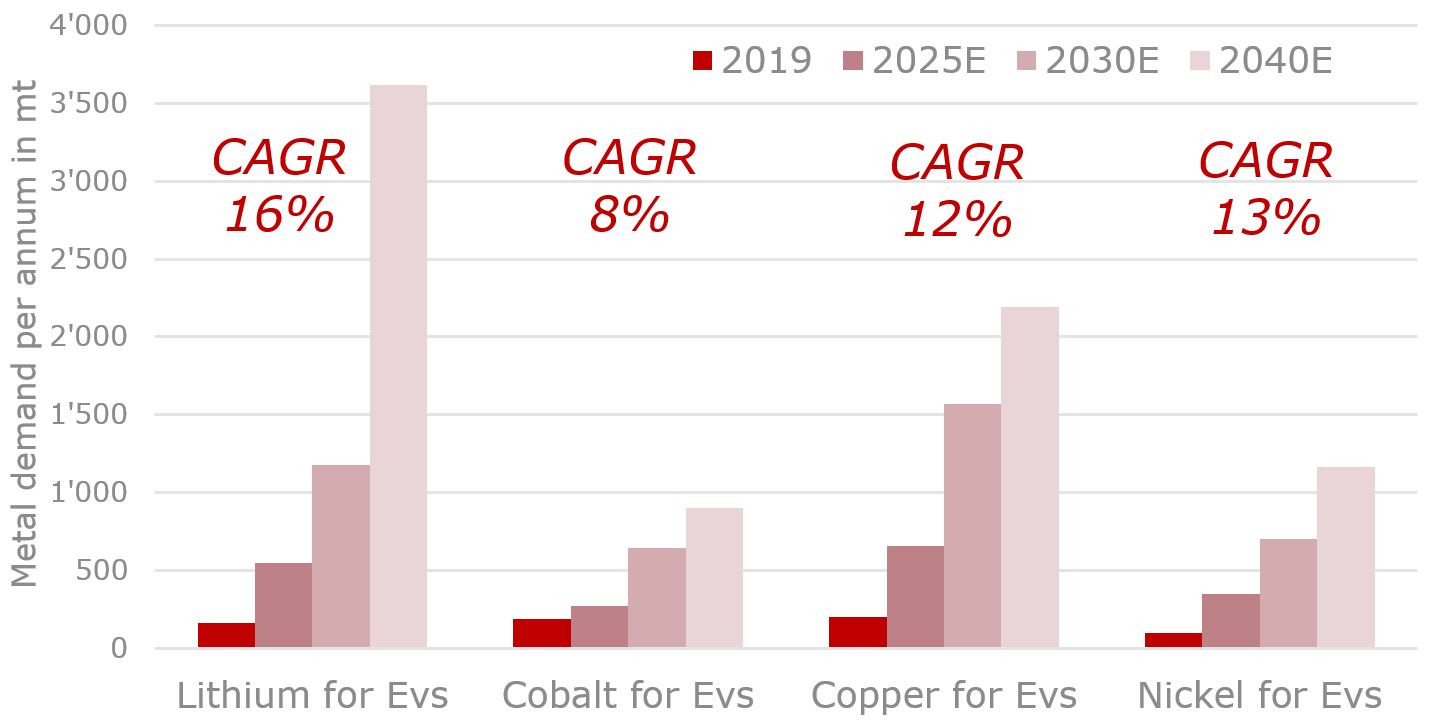

Die Elektromobilität erfreut sich zunehmender Beliebtheit. Die Regierungen subventionieren die Technologie, aber auch Hersteller versuchen mit neuen, günstigen Modellen die Popularität zu steigern. Die IEA erwartet bis ins Jahr 2040 mehr als 280 Millionen Elektro- und Hybridfahrzeuge auf den Strassen – Bloomberg New Energy erwartet sogar über 500 Millionen. Die Nachfrage nach neuen Elektrofahrzeugen geht Hand in Hand mit der Nachfrage nach Batterien und den entsprechenden Materialien, die dafür gebraucht werden – Ein Elektroauto braucht beispielsweise doppelt so viel Kupfer wie ein Auto mit klassischem Verbrennungsmotor.

Eine zentrale Rolle in der Produktion spielt ausserdem Nickel, dessen Nachfrage für Elektrofahrzeuge von 128‘000 Tonnen im Jahr 2019 auf über 265‘000 im 2025 und 1.23 Millionen Tonnen im 2040 steigen soll – dies entspricht fast einer Verzehnfachung. BHP, einer der grössten Minenfirmen der Welt, geht sogar davon aus, dass sich die Nachfrage nach Nickel für Batterien bis ins Jahr 2030 verdreizehnfacht. In diesem Zeitraum wird der Anteil der Nachfrage von Elektrofahrzeugen von 4% auf über 31% steigen. Als Vergleich, im 2019 wurden insgesamt 2.7 Millionen Tonnen Nickel produziert, wobei Indonesien, der grösste Nickelproduzent, ca. 800‘000 Tonnen dazu beigesteuert hat.

Ebenfalls zentral und oft thematisiert ist das Material Lithium. Der Rohstoff ist zwar reichlich in der Erdkruste vorhanden, viele Vorkommen sind jedoch aus Kostensicht schwierig abbaubar. Gemäss Analysten wird sich die Nachfrage nach Lithium bis 2025 vervierfachen. Ein Tesla Model S braucht rund 80 Kilogramm Lithium, zum Vergleich, ein Smartphone braucht ca. 3 Gramm – sprich, ein Tesla Model S braucht die gleiche Menge Lithium wie ca. 26‘000 Smartphones. Auch Kobalt gehört zu den zwingend Notwendigen Metallen für die Elektromobilität. Der Akku eines Elektroautos enthält ca. 3000-mal mehr Kobalt als dieser eines Smartphones. Die aktuelle Kobalt-Jahresproduktion reicht nicht einmal für halb so viele Autos, wie die Industrie sie schon bald jedes Jahr bauen will.

Herausforderungen der Minenindustrie – Grosse Nachfrage, kaum Investoren

Wir haben festgestellt, dass die Energiewende den nächsten Megatrend für Industriemetalle einläutet. Oft in diesem Zusammenhang erwähnte Rohstoffe wie Lithium, Kobalt und seltene Erden sind von grosser Bedeutung, unterschätzt werden jedoch nach wie vor die klassischen Metalle wie Kupfer und Aluminium. Eine kohlenstofffreie Wirtschaft stellt die Minenindustrie vor grosse Herausforderungen. Das heutige Angebot an Rohstoffen, die für die Energiewende benötigt wird, ist mehr als unzureichend – Minenfirmen müssen also in zukünftige Kapazität investieren – und dies in einem Umfeld, in dem der Rohstoffsektor von Investoren gescheut wird und die Finanzierung knapp ist. Ausserdem können die Explorationsbemühungen der Unternehmungen kaum mit der Zunahme der Nachfrage mithalten. Es muss beachtet werden, dass die Zeit zwischen Entdeckung eines Vorkommens und der Produktion bis zu 10 Jahre beträgt – zusätzlich wird es immer schwieriger sowie kostenintensiver qualitativ hochwertige Vorkommen überhaupt zu finden.

Die Wertschöpfungskette von Rohstoffen ist enorm komplex. Nicht alle theoretischen Reserven sind aus wirtschaftlicher oder technologischer Sicht abbaubar. Darüber hinaus ist der Bergbau häufig mit erheblichen ökologischen und sozialen Kosten verbunden, was uns zum nächsten Problem führt. Der Abbau der benötigten Rohstoffe erfolgt in einigen ausgewählten Ländern. Geopolitische Mächte werden sich von öldominierten Ländern zu kritischen metalldominierten Ländern verlagern. In Ländern mit politischer Instabilität, in denen die Regulierung für den Rohstoffsektor schwach ist, kann die Gewinnung dieser Mineralien mit Gewalt, Konflikten und Menschenrechtsverletzungen verbunden sein. Der Kobaltabbau in der Demokratischen Republik Kongo, wo sich über 50% der weltweiten Reserven konzentrieren, wurde zum Beispiel so oft mit Gewalt in Verbindung gebracht, dass der Rohstoff von verschiedenen Nachrichtenagenturen als „Blutdiamanten dieses Jahrzehnts“ bezeichnet wurde.

Es ist also schwierig, einen raschen Anstieg der globalen Nachfrage mit einem vergleichbaren Anstieg des Angebots zu bewältigen. Minenfirmen benötigen eine langfristige Investitionssicherung, um neue Bergbau- und Raffinerieaktivitäten finanzieren zu können. Bei der Neugestaltung von Systemen zur Eindämmung des Klimawandels haben wir die Möglichkeit, die Art und Weise, wie wir mit den natürlichen Ressourcen insgesamt umgehen, zu überdenken und Systeme zu priorisieren, die die Lebensqualität des Menschen verbessern. Erneuerbare Energien sind für eine nachhaltigere Wirtschaft von entscheidender Bedeutung. Der effektive Übergang zu umweltfreundlicherer Energie erfordert jedoch auch eine Kreislaufwirtschaft für kritische Metalle.

Industrial Metals Champions Fund (IMC)

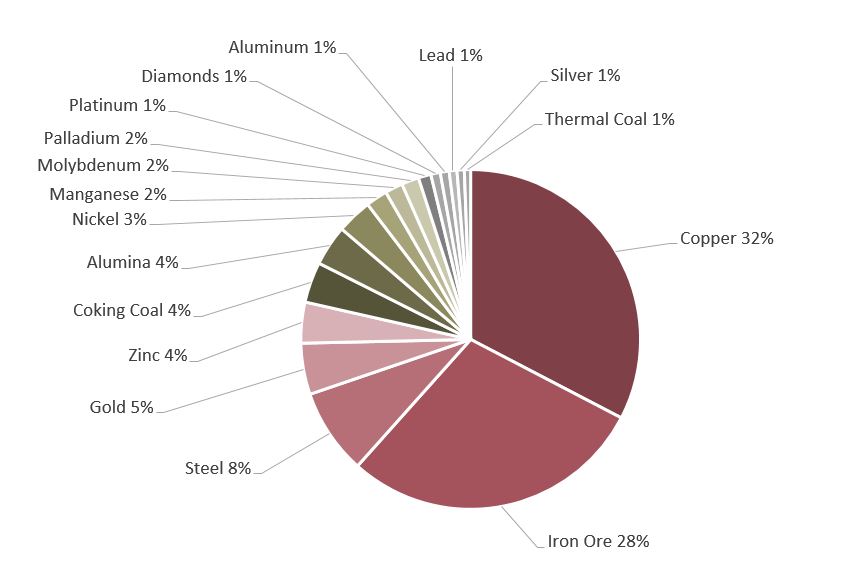

Die Independet Capital Group (ICG) fokussiert sich seit über 20 Jahre auf Rohstoff und Rohstoffaktien Investments. Unsere Anlagelösung, der Industrial Metals Champions Fund (IMC), setzt auf den Megatrend Energiewende und probiert anhand eines systematischen Investmentansatz die best-in-class Minenfirmen auszuwählen, die von der steigenden Nachfrage nach Industriemetallen profitieren können. Der IMC ist der weltweit einzige Minenfonds der sich auf Industriemetalle fokusiert. Das Portfolio des IMC setzt sich aus 25 Aktien des Industriemetall-Sektors zusammen und bietet rohstoffspezifische aber auch länderspezifische Diversifikation. Unser Investmentprozess basiert auf einem quantitativen Ansatz und versucht mittels eigens entwickelter Scorecard emotionale Entscheide konsequent auszublenden. Die Scorecard beruht auf standardisierten Daten um Firmen im Rohstoff-Universum einordnen und vergleichen zu können, wobei sie anhand von verschiedenen finanziellen, unternehmensspezifischen aber auch operativen Kennzahlen verglichen werden. Die ICG Alpha Scorecard stützt sich auf 6 Säulen – Asset Quality, Value, Sustainability (ESG), Dividends, Balance Sheet und Behavioral Finance.

Questions & Answers

Ist die Minenindustrie nicht eine der grössten Klimasünder?

Wie jede maschinenintensive Industrie verursachen auch Minenfirmen CO2 und Treibhausgase. Sustainability Kriterien fliessen jedoch zusätzlich zu finanziellen und operativen Kennzahlen in unseren Investmentprozess mit ein und werden laufend überprüft. Der Industrial Metals Champions Fund weist bedeutend bessere Kennzahlen (Bsp.: CO2-Ausstoss pro produzierte Tonne, Treibstoffverbrauch, Treibhausausgasausstoss pro produzierter Tonne, etc.) aus als gängige Minenindices und andere Minenfonds. Ausserdem, neben ökologischen Kennzahlen fliessen auch solche aus Sicht der Governance (Unternehmungsführung) ein – beispielsweise untersuchen wir den prozentualen Anteil von Frauen im Management einer Firma und favorisieren diese, welche eine gesunde Balance ausweisen.

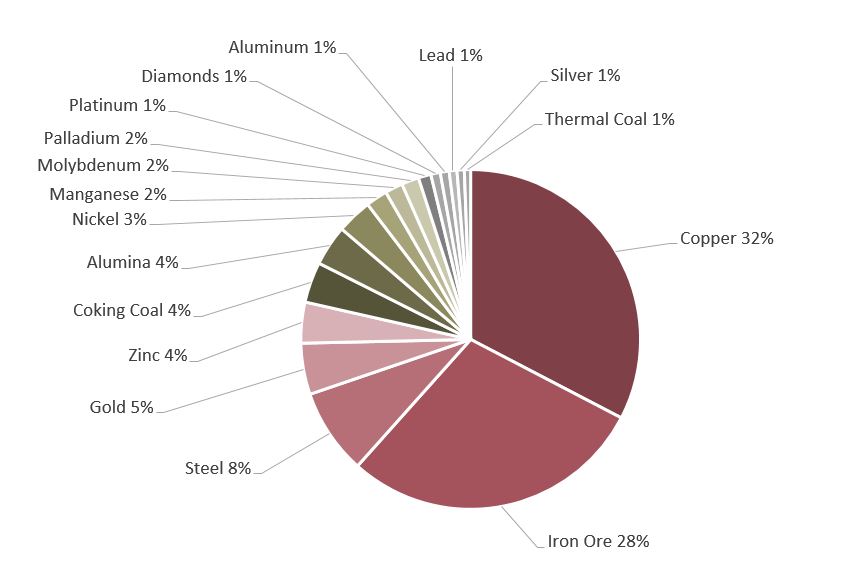

In welche Rohstoffe investiere ich mit dem Industrial Metals Champions Fund?

Aufgrund unserer genauen Analyse der Firmen im Portfolio können wir genau aufzeigen, wie viel Prozent des Portfolios dem entsprechenden Rohstoff zugeordnet werden kann.

Wieso investiert der IMC momentan nicht mehr in Lithium oder Kobalt?

Unser eigens entwickelter Risikofaktor berücksichtigt jeden Rohstoff und stuft ihn auf seine momentane Attraktivität ein. Vereinfacht gesagt, dieser Faktor hilft uns dabei, den richtigen Einstiegszeitpunkt für den entsprechend Rohstoff zu finden. Sowohl der Lithium- als auch der Kobaltmarkt ist momentan in einem Überschuss – zum jetzigen Zeitpunkt gibt es attraktivere Alternativen um von der Energiewende zu profitieren. Kurz- bis mittelfristig werden sich die fundamentalen Daten dieser Märkte erholen und entsprechend wieder attraktiv als Investment. Wir haben sämtliche Lithium, Kobalt und Rare Earth Firmen in unserer Scorecard und prüfen diese regelmässig.

In welchen Ländern sind die Firmen des Fonds aktiv?

Wir untersuchen nicht nur welche Metalle die Firmen produzieren, sondern auch wo. So können wir einerseits auf politische Ereignisse reagieren, aber auch Investitionen in politisch unstabile Länder reduzieren oder ggf. vermeiden.

Wie kann ich investieren?

Der Industrial Metals Champions Fund ist ein Liechtensteiner UCITS contractual fund. Der Fonds verfügt über eine USD-Klasse (Valor: 38215435, ISIN: LI0382154354) und eine CHF-Klasse (Valor: 38215469, ISIN: LI0382154693) – beide Klassen sind täglich handelbar. Eine Institutionelle Klasse wird bald für Investoren verfügbar sein.

Wieviel muss ich mindestens investieren?

Zeichnen kann man ab einem Anteil. Der Preis eines Anteils kann täglich via Bloomberg und Swiss Fund Data abgefragt werden. Die Institutionelle Klasse ist ab einer Investition von USD 1 Million zugänglich.

Wie kann ich weiterhin auf dem Laufenden bleiben?

Das Investment-Team der Independent Capital Group veröffentlicht jeweils zum Beginn des Monats einen Newsletter, welcher neben einem aktuellen Marktkommentar auch sämtliche Informationen zum Fonds beinhaltet. Gerne können Sie sich für diesen Newsletter anmelden oder eine Präsentation zu unserem Fonds anfordern.

Sämtliche Daten und Kennzahlen sind per 20.10.2020

Sources: International Energy Agency – World Energy Outlook 2020; World Bank – Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition (2020), The Geopolitics of the Global Energy Transition – Minerals and the Metals for the Energy Transition: Exploring the Conflict Implications for Mineral-Rich, Fragil States (Author Clare Church, 2020), Global metal flows in the renewable energy transition: Exploring the effects of substitutes, technological mix and development (author: André Manberger; Björn Stenqvist, 2018), Bloomberg, Reuters, mining.com, Goldman Sachs, JPMorgan, Credit Suisse, UBS, BMO, Independent Capital Group Database

Read More